Get an American General Life Insurance quote right here if you're shopping for coverage.

American General or AIG offers very competitive term life and permanent universal life insurance rates.

They recently rebranded their life insurance and retirement divisions to Corebridge Financial.

With an A (Excellent) AM Best financial strength rating, American General/AIG- Corebridge could be the best insurance company for you and we always include them in our inquiries while shopping every life insurance case.

They do business as United States Life in the State of NY.

American General is owned by AIG, now Corebridge Financial

Our relationship with key people in American General’s underwriting department can result in best case offers for you. We’ve learned over the years that all offers are negotiable and we will negotiate the best offer for you.

While you could also apply through AIG Direct, then you'd have NO negotiating power like you would if you dealt with an independent agency like us that can shop with all insurance companies to get you the absolute best rate and value.

Click link below if you’d like an accurate American General Life insurance quote and at the same time we’ll compare American General’s quote to Banner Life, Protective Life, Pacific Life, Principal Life, Thrivent Financial and all of the other insurance companies that could be better for you.

American General AIG Not Best For Everyone

Just know that American General will never make best offer on every case.

We regularly submit dual apps to American General and Banner Life, or Protective Life, or any other insurance company that may end up making better offer or provide a better value to our clients.

We do this since there is no way to know the exact offer that any life insurance company will make until you go through the underwriting process.

We can have you apply to American General and other carrier at same time

If a free insurance exam or review of medical records is required, anything could turn up that may preclude you from a better rate category with American General and for which another carrier may make you better offer.

For any case that American General could be best, about 50% of the time American General makes best offer and about 50% of the time Banner Life or another insurance company ultimately makes best offer.

So you’ll always have to shop for other offers, or just let us do it for you as our system cannot be beat!

American General- impaired risk life insurance

Below are some underwriting niche's where American General Life/AIG can stand out from the competition:

- Life insurance for diabetics Type 1 and Type 2

- Crohn’s disease

- Autoimmune disorders

- Sleep apnea

- Multiple sclerosis

- Asthma

- Stent, Bypass, Heart Attack

- One Cigar Per Week for Preferred Plus non-smoker

American General life insurance has a special table rating structure that can give them an advantage over most of the competition.

Every once in a while, they make a good offer on a random health issue not shown above. For this reason we always request preliminary offer from American General as they've surprised us and come through many times!

An American General life insurance quote should always be considered if you have any health issue, whether it’s a major or minor issue.

AIG Quality of Life Products

AIG has a separate division of term and permanent life insurance products called Quality of Life or QoL that include chronic and critical illness living benefits.

The chronic illness living benefit would enable you to accelerate payment of your insurance amount if you become chronically ill and cannot do 2 of the 6 activities of daily living (ADL's) without assistance.

The ADL's are eating, bathing, continence, dressing, toileting and transferring.

The critical illness living benefit would enable you to accelerate payment of your insurance amount if you suffer from the ailments below:

- Major Heart Attack

Coronary Artery Bypass

Stroke

Major Organ Transplant

End Stage Renal Failure

Paralysis

Coma

Severe Burn

Invasive Cancer

Blood Cancers: Leukemia, Lymphoma, Multiple Myeloma and Myelodysplastic Syndromes

AIG QoL products need to be compared to the other carriers that offer living benefits including Ameritas, Columbus Life, Foresters, North American Co. for Life & Health and the others.

Specify if you'd like an AIG QoL American General life insurance quote and we'll compare to others.

Niche’s for which American General is Competitive

They offer odd guaranteed level premium term periods from 15 to 35 years (i.e. 16 year, 17 year, 23 year, 27 year term, etc.). This is perfect if you may only need coverage for an odd period of time, like to cover your remaining mortgage.

They are also one of the few companies that offer 35 year term insurance policies.

While American General offers several types of permanent life insurance, their Guaranteed Universal Life rate called the AG Secure Lifetime GUL II is currently their most competitively priced permanent coverage.

Any mild impaired risk who qualifies for a Table B rating on their GUL product automatically gets upgraded to a Standard or Regular rate.

Table B rating automatically upgraded to Standard on permanent insurance

American General's GUL product is also one of the few that actually builds cash value.

Plus they offer a unique rider on their GUL called the Lifestyle Income Solution rider which allows access to your death benefit for any reason after age 85 which is perfect to protect against outliving your retirement assets.

American General does offer a no medical exam Guaranteed Issue Whole Life Insurance policy to help pay for final expenses.

AIG does also offer Quality of Life products that include chronic and critical illness living benefits.

Negatives About AIG American General Life

While they have do some great products and they can do great in underwriting tougher cases, American General AIG's customer service is not always great.

While they have improved over the years, we recommend that all of our clients contact us for customer service issues instead of contacting American International Group, inc. on their own.

We have contacts at American General which makes it easier for us to handle customer service issues and then you won't have to deal with some random AIG Life customer service person that may or may not be any good.

American General has also recently been putting to much emphasis on the RX histories or Millman Intelliscript report when making underwriting decisions...

This is a mistake as we've caught wrong info on these reports on past cases.

Bottom Line- American General Life Companies

AIG American General Life is a great company with very good life insurance products and they do some unique things in the life insurance industry.

Whether you want term life insurance or permanent life insurance coverage, you should get a quote to see if they may be a good fit for you.

Click here to email us if you have questions or need more information. Or call or text us at 800-380-3533.

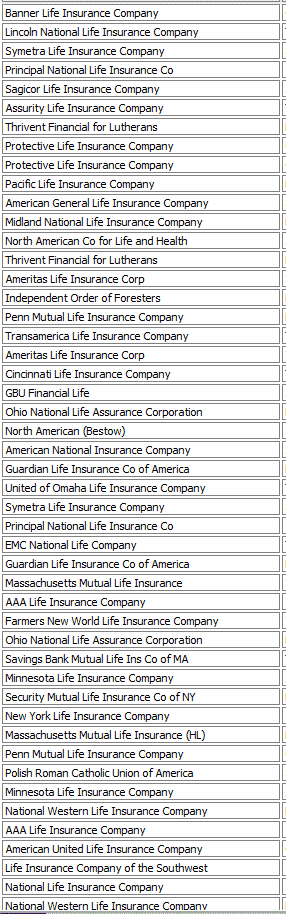

Click the Quote button above and complete questionnaire and we'll automatically email you an American General life insurance quote and the best quotes from other insurance companies that may provide you with a lower cost or better value!! (see screenshot below with small portion of our database with some carriers we'll shop with on your behalf) .